New Warehouse in Holland – Now Open for Business

The Maurice Ward Group is once again growing its physical footprint in Europe with the addition of a new warehouse in a strategically important location.

Express Road Shipments: When every minute counts, you can count on us! Start tour >

January 29, 2024

We are 29 days into 2024 and a month has gone by since the major carriers began re-routing around Africa due to the Red Sea crisis.

The new year has unsurprisingly started with a continuation of the uncertainty created by the attacks on the vessels of the leading container lines Maersk & Hapag-Lloyd on December 15th.

Since then, a significant number of container vessels are still on hold in the Red Sea not going anywhere. Going south continues to pose risks, whereas going around Africa would be a costly transit to get back north to the Mediterranean.

Several ultra-large containerships, previously stranded in the Red Sea due to the conflict between the Houthis in the south and the costly transit through the Suez Canal to the north, have begun to resume their journeys.

Let us try to get some proportions into the discussion surrounding the cost of avoiding the Red Sea.

Headlines create the impression that global trade itself is under threat which is not the case. While it’s evident that some shippers are facing significant challenges, resulting in high freight rates, it’s essential to recognize that these extremes do not represent the overall market. Globally, world trade has become more expensive, but not at a destructive level.

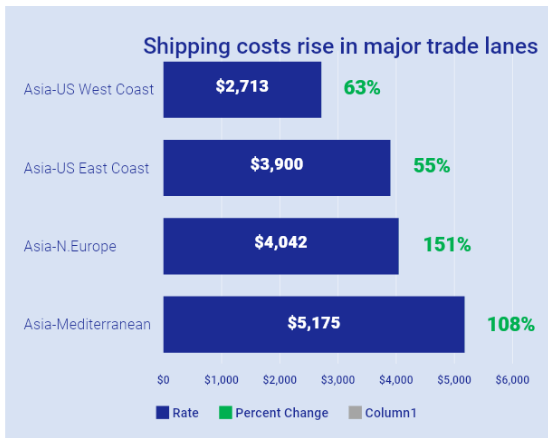

Source: Freightos

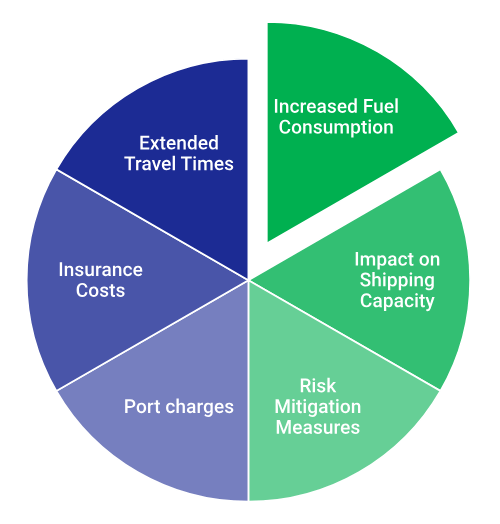

The escalation in shipping costs caused by longer routes prompted by attacks in the Red Sea can be attributed to various factors. When vessels are compelled to adopt extended routes, several elements contribute to the rise in expenses, including:

It is evident that some of the price increases carriers are pushing for surpass the added costs linked to sailing around Africa. But before shippers take offense by this, it is worth noting that pricing strategies in most industries, and not just container shipping, are typically based on the supply/demand situation and the customers’ willingness to pay.

Recent attacks have caused significant disruptions to shipping through the important route that connects to the Mediterranean Sea. The latest Houthi attack occurred shortly after the United States and Britain carried out airstrikes on about 30 Houthi targets in western Yemen in response to the threats in the Red Sea.

The US has also announced a 10-country coalition to protect shipping in the area. But this still raises two unanswered questions: When will such a coalition have sufficient naval assets in the area to reassure shipping lines to start going through the channels again? And how do they plan to address the issue of Houthis still being able to launch missiles and drones at will from land?

Just a month ago hardly anyone was prepping their contingency plans for rerouting shipments around Africa. Not that anyone could have made tangible plans, however, it’s worth reflecting on how well-prepared your organization is to suddenly deal with such a problem. With that in mind, you might want to be prepared for additional contingencies if the crisis escalates further.

As the supply chain navigates through these challenges, we are always looking for optimal solutions for our customers.

We continue to monitor the situation closely and keep you informed of any developments that may impact your shipments.

A few of the increases imposed by lines:

Back in late December, Hapag-Lloyd had announced a 500 USD contingency charge for the Atlantic trade.

MSC announced a new FAK rate from Asia to Med at 7100-7300 USD/FFE valid from 15 JAN.

Maersk has announced a new PSS for East Med to North Europe at a level of 200 USD per container.

CMA CGM has announced an increase in the FAK rate from Asia to North Europe at 3000 USD/FFE on the 1st of January and further up to 6000 USD/FFE on 15th January.

Let’s take a look at some examples from the online schedules of the global who are diverting main vessels around Africa:

Hapag-Lloyd offering Jeddah to Aden in Yemen onboard the feeder services from X-press Feeders.

CMA CGM using the same feeder also serving Hodeidah port.

ONE’s online schedule offers Jeddah to Djibouti onboard a Global Feeder Shipping vessel.

Maersk issued an advisory stating that to keep providing us with their global services, they are introducing the Congestion Fee Origin (CFO) for all containers for the scope of: Yemen to World and Maersk is also revising the Congestion Fee Destination (CFD) for the scope: World to Yemen for all containers effective 10th January, 2024.

The first ever ‘cargo only’ flight was recorded in November 1910 in the USA, using a Wright Model B aeroplane that flew 65 miles carrying a package of silk. The business owner used the pioneering transport more as a PR stunt to celebrate the opening of his store, with the bundle of silk cut into individual pieces and glued onto souvenir postcards.

The Maurice Ward Group is once again growing its physical footprint in Europe with the addition of a new warehouse in a strategically important location.

Maurice Ward Croatia is starting an exciting new phase with Matija Sajko as the newly appointed Branch Manager. As a total logistics services provider, this branch offers End-to-End logistics solutions, from the smallest packages to bulk movements, every shipment handled with care.

On October 4th, Maurice Ward France proudly inaugurated its new headquarters, located in Genas near Lyon airport. This is a significant milestone in the company’s journey and reflects its ambitious vision for the future. With modern design and advanced facilities, the new headquarters will be a hub for French operations, teamwork, and growth.

Maurice Ward Group is the term used to identify collectively all Maurice Ward companies. These companies are each separate legal entities acting for their own risk and account or their principals. They can only bind themselves and the other Maurice Ward entities are not liable for their actions. The use of the term Maurice Ward Group on this website or by any of the other Maurice Ward companies in any document or mean of communication is for practical reasons only.

| Cookie | Duration | Description |

|---|---|---|

| VISITOR_INFO1_LIVE | 5 months 27 days | A cookie set by YouTube to measure bandwidth that determines whether the user gets the new or old player interface. |

| YSC | session | YSC cookie is set by Youtube and is used to track the views of embedded videos on Youtube pages. |

| yt-remote-connected-devices | never | YouTube sets this cookie to store the video preferences of the user using embedded YouTube video. |

| yt-remote-device-id | never | YouTube sets this cookie to store the video preferences of the user using embedded YouTube video. |

| yt.innertube::nextId | never | This cookie, set by YouTube, registers a unique ID to store data on what videos from YouTube the user has seen. |

| yt.innertube::requests | never | This cookie, set by YouTube, registers a unique ID to store data on what videos from YouTube the user has seen. |

| Cookie | Duration | Description |

|---|---|---|

| pll_language | 1 year | The pll _language cookie is used by Polylang to remember the language selected by the user when returning to the website, and also to get the language information when not available in another way. |